How we inspect and manage industrial assets has not kept pace with the rate of technological change. While some industries have embraced real-time data, automation, and predictive models, risk-based inspection (RBI) in the energy and process sectors remains tethered to outdated assumptions and rigid methodologies.

In Cenosco’s latest asset integrity webinar, domain expert Rowan and technical writer Tomislav delivered a candid and forward-looking exploration of the current RBI landscape.

Their message was clear: although traditional RBI approaches have served industry well, there is room for significant improvement. To enhance safety, reliability, and efficiency in increasingly complex asset environments, the industry must move from relying on static risk models to dynamic ones.

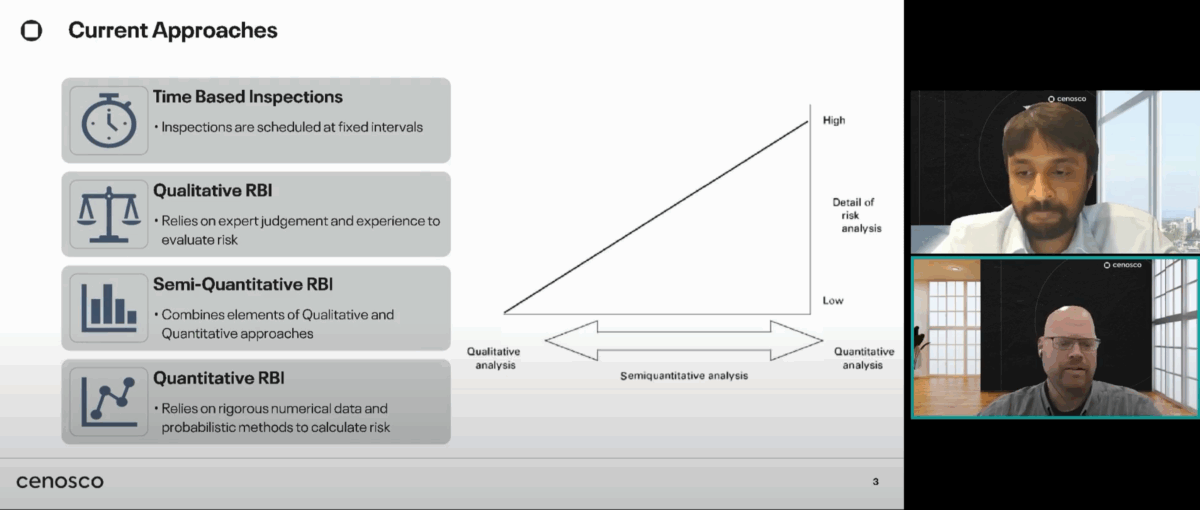

Four Approaches, One Problem

The RBI methods most commonly used today fall into four categories: time-based, qualitative, semi-quantitative, and fully quantitative. Each represents a step forward in terms of theory and complexity, but all suffer from the same underlying flaw. They rely on periodic, isolated data inputs and often fail to account for the real-time operational context of assets.

Time-based inspections are still widely used for their simplicity and regulatory acceptability. But this convenience comes with significant costs. They treat all assets equally, regardless of condition, leading to over-inspection and missed degradation. Qualitative approaches depend heavily on expert judgment and experience, which introduces subjectivity and inconsistency. Semi-quantitative methods add structure through scoring systems and risk matrices, but they still lean heavily on assumptions and often rely on outdated or incomplete data. Fully quantitative approaches promise greater accuracy through statistical models and real-time data, but are often out of reach due to the resource demands and data quality requirements.

What these models lack is the ability to evolve in real time. They capture snapshots, not movement. And in a world where conditions change continuously, that makes them fragile.

The Digital Maturity Problem: Why RBI Stagnates

One of the most telling insights from the webinar was that many organizations have not yet moved beyond the pre-digital phase of integrity management. Paper forms, Excel sheets, and Word documents are still in active use in some operations. Even those who have adopted RBI software often operate within silos, where inspection data, risk evaluations, and work order management remain disconnected.

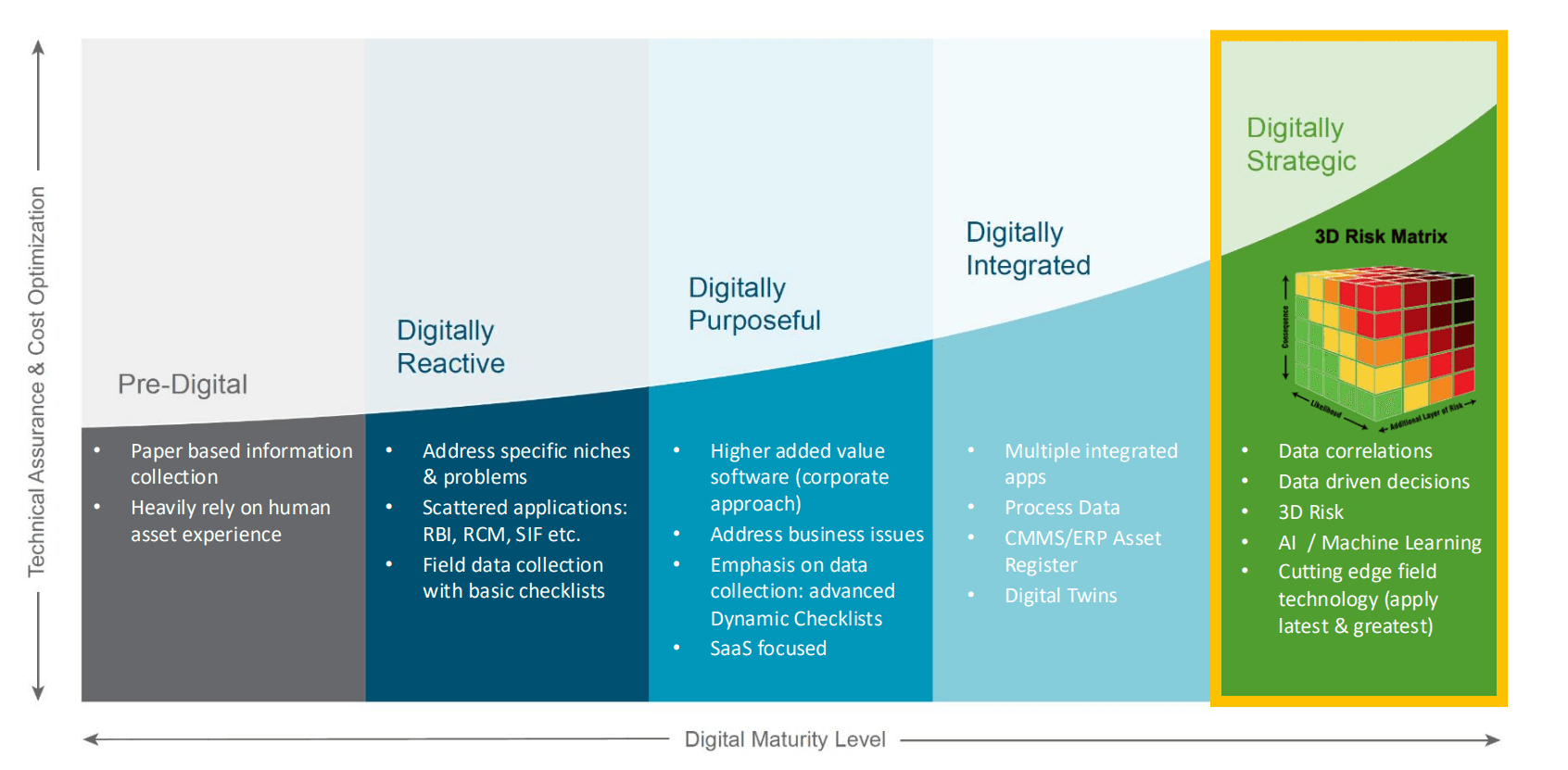

Rowan described the stages of digital maturity as a continuum: pre-digital, digitally reactive, digitally purposeful, digitally integrated, and digitally strategic. Most companies sit somewhere in the middle, with aspirations to move toward integration but without the systems, budgets, or cultural alignment to get there.

Even in digitally integrated environments, where inspection and risk tools communicate, critical decisions often still depend on manual reviews and updates. The result is delayed response times, outdated risk assessments, and inspection plans that fail to reflect current asset realities. Integration is necessary, but not sufficient. What is required is continuous, dynamic evaluation informed by high-frequency, high-quality data.

Why Dynamic RBI Matters

The core of the argument for dynamic RBI is this: static systems, even when digital, cannot keep up with the pace of change in asset conditions. Sensors, remote imagery, automated inspections, and real-time monitoring all generate enormous volumes of data. This data holds the key to more accurate and responsive risk assessments, but only if it can be analyzed, understood, and applied meaningfully.

Dynamic RBI involves more than just data collection. It requires models that can process continuous inputs, adapt to changing conditions, and trigger actions based on real-time thresholds. This means integrating not just inspection data, but also process variables, sensor outputs, and operational changes. It means transitioning from manual updates to automated feedback loops.

Rowan and Tomislav outlined a vision of integrity management in which degradation rates are updated as conditions change, not years later. Inspections are triggered based on actual risk profiles, not predefined intervals. And engineers’ expertise is enhanced, not replaced, by data-driven tools that highlight anomalies and recommend next steps.

Cultural and Structural Resistance

The technological capability for dynamic RBI exists today. What stands in the way is often culture, organizational inertia, and fragmented systems. Many teams still ask, if our current RBI process works, why change it? But that question assumes stability in a world that is increasingly unpredictable.

Another major barrier is infrastructure. As Tomislav pointed out, dynamic RBI requires robust IT environments capable of processing and storing exponentially more data than traditional systems. Cloud-based platforms can mitigate some of this burden, but implementing these tools at scale demands investment, planning, and cross-functional alignment.

There is also the regulatory challenge. Risk-based approaches have gained broad acceptance from regulators, but dynamic models that leverage AI and continuous monitoring remain new territory. The solution, as both speakers noted, is parallel validation. New models must be tested against existing standards to demonstrate equivalent or better risk control.

What Does This Mean in Practice?

A few practical shifts signal what this transformation might look like:

- Risk evaluations will rely less on inspection intervals and more on continuous data from sensors and monitoring systems

- Workflows will increasingly be automated, with alerts and triggers based on real-time data

- Inspection findings will be fed directly into updated risk models, eliminating months of lag time

- Organizations will begin to share and apply insights across multiple assets, building institutional intelligence that scales

Critically, this is not just a matter of software upgrades. It is a structural change in how organizations understand and manage risk. The transition will take time, but the value is clear: improved safety, reduced unplanned downtime, more efficient resource use, and a more agile response to operational changes.

Looking Ahead: “It’s Not If, It’s When“

The webinar ended with a bold prediction: organizations that invest early in dynamic RBI and digitally strategic systems will lead the next decade of industrial performance and reliability.

Everyone else? Risk falling behind – ironically, in the name of managing risk.

As assets age and operational pressures increase, organizations will need to adopt more adaptive, integrated, and intelligent approaches to integrity management. The tools are here. The data is available. What remains is the will to act.

Cenosco is actively building the foundation for this shift. With solutions supporting near-real-time feedback, advanced analytics, and system integration, we enable organizations to move from reactive to strategic risk management. It’s still early in the process, but the companies that invest in adopting the systems and processes to support dynamic approaches to risk-based inspections today will be the ones leading the industry tomorrow.

The question isn’t whether change will happen – it’s whether your organization will lead or fall behind the pack.

Pronto para uma demonstração?

Está pronto para ver o IMS Suite em ação? Preencha o formulário abaixo para marcar uma demonstração!